If you are into trading in 2025, you need to know about support and resistance levels first. In the US, there are 482,200 traders already.

Of them, 7.4% started trading between 2022 and 2032. So, with a lot of new traders onboard, they must learn the thresholds of trading!

Without beating around the bush, let’s get to know what support and resistance levels are and how they affect forex trading.

Support in forex trade is the area in charts that indicates the willingness among traders to buy a stock. Meanwhile, the resistance refers to the point where the demand level exceeds supply in the price chart!

When do we see Support and Resistance in Charts?

Unless you can predict support and resistance, you can’t grow big with forex trading. Firstly, support occurs when a fall is marked in the forex market.

Certainly, a downward trend will appear on the chart when that happens. So, what happens when a support position appears on the chart? If you appoint the Best Copy Trading Broker, you can check out the strategies that seasoned traders follow.

Traders pause at support positions. They either sell the stock at that point or keep clinging to it in the long term. They’ll wait until the demand improves and creates an equilibrium with the supply level in the market!

Once the equilibrium is reached, the forex price won’t drop anymore.

Now, coming to resistance. When prices increase and the supply is more than the demand, you may want to take a “sell” position there. Rarely would you buy more stocks. I mean, that’s why the supply is more in the market. We call it a resistance level.

But new traders may question, Why does the resistance band appear? Firstly, it happens when traders cumulatively feel that the prices in the forex chart are way higher.

Meanwhile, a sell-off trend sets in when traders have reached their intended profit levels. Again, that’s possible when the forex prices are naturally high.

Identifying Trendlines and Trading Accordingly

You can identify trendlines by monitoring the opening and closing price points. You can track these two points of a particular stock or multiple stocks at the same time.

In the forex chat, you can closely observe the candlesticks too. The range between the candlesticks is a marker for the trendline.

As a beginner, you may just get to know the pattern in the market, following a trendline. But seasoned traders use it to do technical analysis and rank assets.

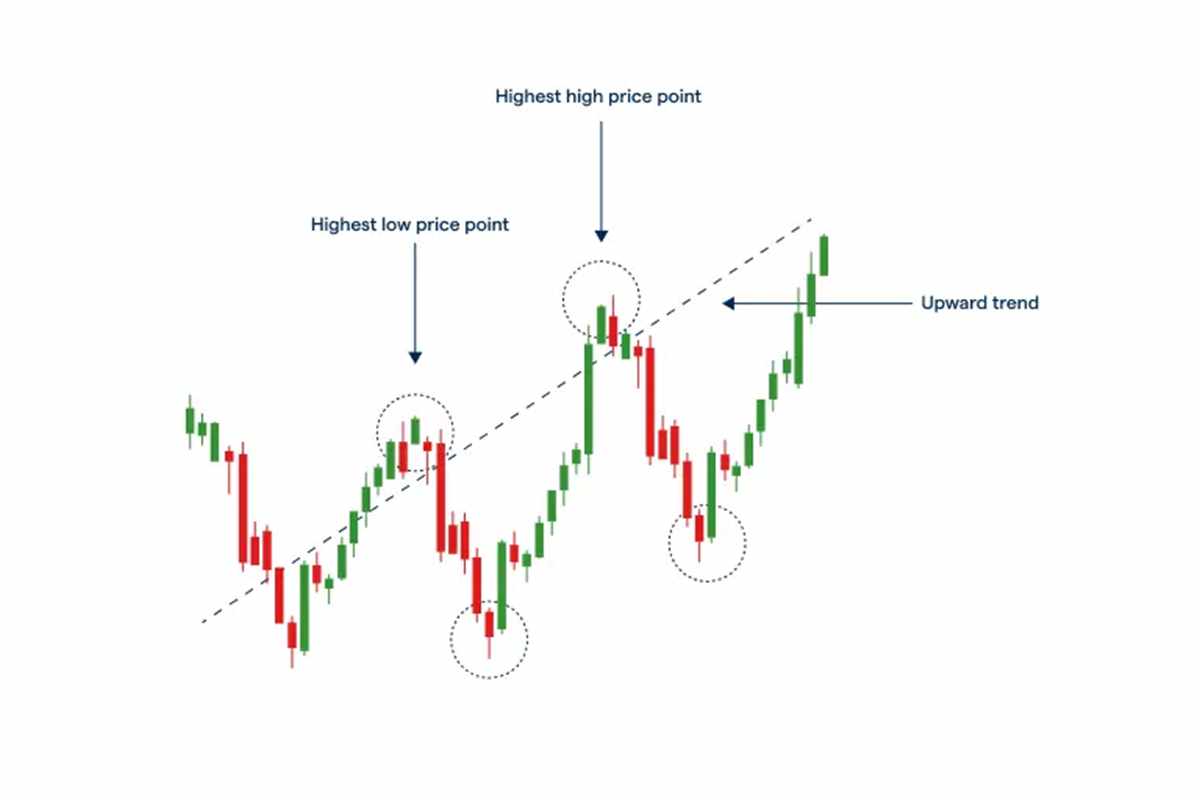

Now, you might ask how support and resistance levels affect or create the trendline. On that note, you must know that an upward trend in the market will create resistance levels. After that, the price will decrease and move closer to the trendline.

On the other hand, a downward market trend means that there will be a support level in the chart. Meanwhile, there are 3 crucial trend-based trading strategies:

Upward trendline

Downward trendline and

Sideways trendline

The Upward Trendline

What does an upward trendline mean for you? Beginners must know that an upward trendline means that the price of the forex pair is going to increase soon.

It also means that the highest and lowest points of the candlestick are comparatively higher, in parity with the forex trendline.

What does it mean when you are trading?

While trading, you have to open with a long position. Meanwhile, your profits will keep soaring when the price level keeps reaching higher.

Downward Trendline

When the forex pair’s price decreases, it symbolizes a downward trendline. As it is juxtaposed to the upward trendline, the candlestick highs and lows would be comparatively lower.

In the same vein, you have to start the trade with a short position. Hence, you can ensure you don’t lose big when the forex price reaches a lower level.

Sideways Trendline

This line appears when the forex market price isn’t reaching either highs or lows. This trendline is suitable for scalpers. Who are they?

Well, scalpers are traders who are interested in the short-term movements of the trendline. As a beginner, don’t take the risk of short-term day trading on your own.

You’ll lack market knowledge and might be prone to errors. So, contact the Best Copy Trading Broker in town and follow the successful tactics of seasoned traders.

Conversely, the long-term traders prefer big highs and lows, which helps them to make bigger profits from a single asset in the forex chart.

Summing Up

Support refers to the area that indicates the willingness to buy. Resistance occurs when the supply exceeds the demand.

If you closely monitor the trendline and candlesticks, you can form the right forex trading strategy!