Investing can feel overwhelming for beginners. With so many options, from individual stocks to bonds and mutual funds, it’s easy to get lost in the complexity of financial markets. Yet, one investment vehicle has stood out for its simplicity, flexibility, and cost-effectiveness: exchange-traded funds (ETFs).

ETFs have gained immense popularity over the past two decades, offering a way to diversify investments without the hefty fees or time-consuming research often tied to stock-picking. For those just starting their financial journey, ETFs provide a bridge between professional-level diversification and everyday accessibility.

This article explores why ETFs are such a powerful tool for beginners, how they work, and what makes them one of the smartest ways to start building wealth.

Understanding the Basics of ETFs

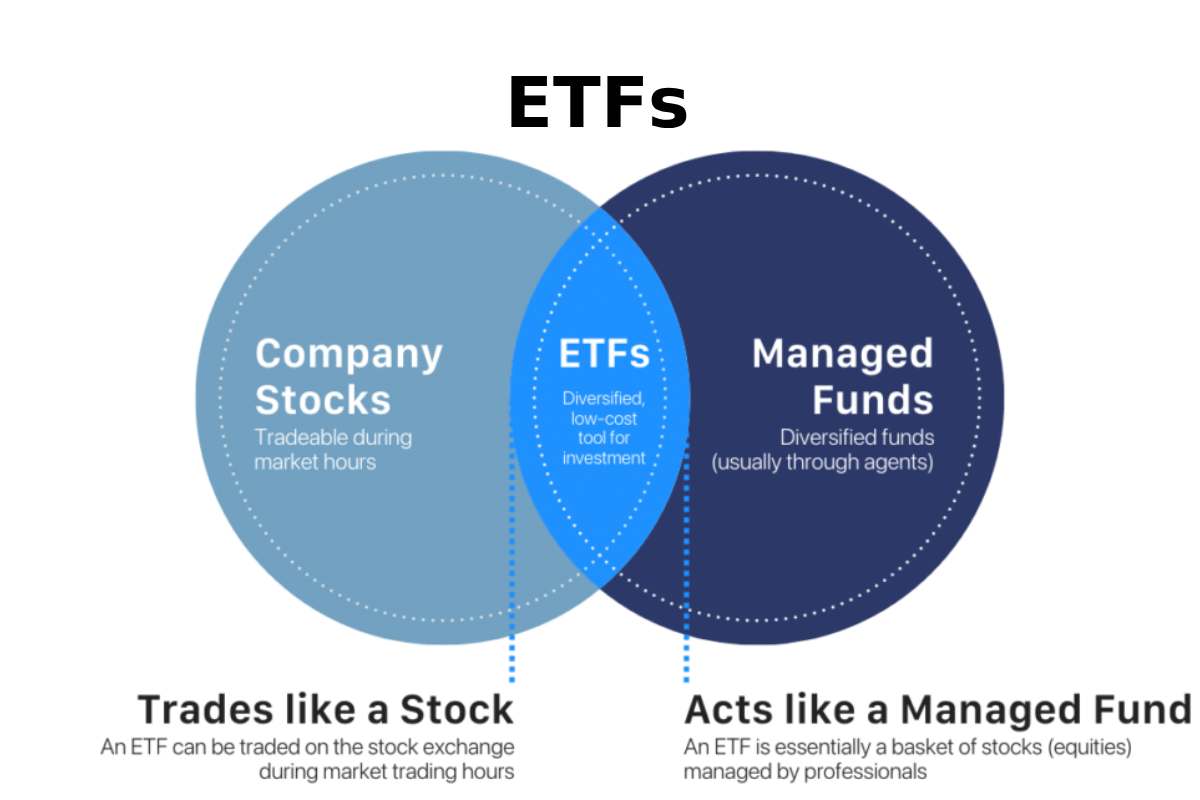

At their core, ETFs are baskets of assets—such as stocks, bonds, or commodities—that trade on stock exchanges just like individual shares. Think of them as a hybrid between mutual funds and stocks.

Like a mutual fund, an ETF holds a collection of different securities, which provides built-in diversification. But unlike mutual funds, ETFs can be bought and sold throughout the trading day, offering more flexibility.

For example, instead of buying shares of multiple companies in the technology sector individually, you could purchase a technology-focused ETF. With that single investment, you instantly gain exposure to dozens of companies in the sector. This makes ETFs particularly appealing to beginners who may not have the time, knowledge, or capital to build a well-diversified portfolio from scratch.

Why Diversification Matters

One of the golden rules of investing is not to put all your eggs in one basket. Markets are unpredictable, and even the strongest companies can face downturns. Diversification helps spread risk across different assets, industries, and regions, reducing the impact of a single underperforming investment.

ETFs make diversification simple and affordable. A single ETF can hold hundreds—or even thousands—of securities, giving investors broad market exposure without requiring them to purchase each asset individually. For beginners, this means achieving balanced portfolios without needing advanced market expertise or significant starting capital.

The Cost Advantage of ETFs

Low costs are another reason ETFs are particularly beginner-friendly. Traditional mutual funds often come with high management fees, which can erode returns over time. ETFs, by contrast, typically have lower expense ratios because most are passively managed. They aim to track the performance of an index—such as the S&P 500—rather than relying on a fund manager to actively pick investments.

Additionally, since ETFs trade on stock exchanges, investors avoid many of the fees associated with traditional funds. This cost-efficiency makes them an attractive option for those who want to potentially maximise returns while minimising expenses—a crucial consideration when starting with smaller amounts of money.

Different Types of ETFs

For beginners, it’s important to recognise that not all ETFs are created equal. Understanding the different categories can help align choices with personal financial goals.

- Stock ETFs: Track collections of stocks from specific sectors, regions, or indices. Great for those wanting equity exposure.

- Bond ETFs: Provide access to government or corporate bonds, often with more stability and lower risk than stocks.

- Commodity ETFs: Focus on physical assets like gold, silver, or oil, often used as a hedge against inflation.

- Thematic ETFs: Invest in companies tied to specific trends, such as clean energy, artificial intelligence, or healthcare innovation.

For new investors, broad market ETFs—like those tracking the S&P 500 or global indices—are often the simplest and safest entry point. They deliver instant diversification across industries and geographies.

What to Know Before Investing

Before diving into ETFs, beginners should equip themselves with a few key insights. Understanding fees, liquidity, and tracking error (the difference between the ETF’s performance and its underlying index) is essential. Equally important is considering one’s investment horizon. ETFs are best suited for those willing to hold investments over the medium to long term, allowing compound growth to work its magic.

For anyone starting, learning what to know about ETFs can make the difference between a haphazard first step and a confident entry into investing. Taking time to research and compare options ensures that the chosen ETFs align with both risk tolerance and long-term goals.

The Psychological Benefit for Beginners

Investing often comes with emotional challenges—fear of loss, overconfidence in trends, or the urge to constantly check markets. ETFs help mitigate these struggles by promoting a long-term mindset. Because they naturally encourage diversification, investors may feel less pressure to time the market or chase individual stock performance.

This peace of mind can be invaluable for beginners. Instead of reacting emotionally to short-term market swings, investors can stay focused on gradual, consistent growth. Over time, this disciplined approach often leads to stronger financial outcomes.

Conclusion

For beginners, represent one of the most accessible and effective ways to begin an investment journey. They offer low-cost diversification, easy access, and enough flexibility to suit different financial goals. More importantly, they help new investors develop the right habits—patience, discipline, and a focus on long-term growth.

In a world where financial decisions can feel daunting, provide clarity and opportunity. By starting with these versatile funds, beginners set themselves on a path toward building wealth with confidence and stability. Whether used as a foundation for a portfolio or a stepping stone into broader strategies, ETFs are proof that smart investing doesn’t have to be complicated.